Explore retirement strategies that defy traditional norms, combine growth with tranquility, and enable your finances to operate more efficiently in CoastFI living.

.jpg)

A listener allowed ChatGPT to create a $1.2M investment portfolio, but can you genuinely rely on AI for investing? We disclose what it accomplished correctly and where it fell short.

Sarah Williamson, CEO of FCLTGlobal and an MBA graduate from Harvard, discusses how investors create long-term value and the influence of capital flows on current markets.

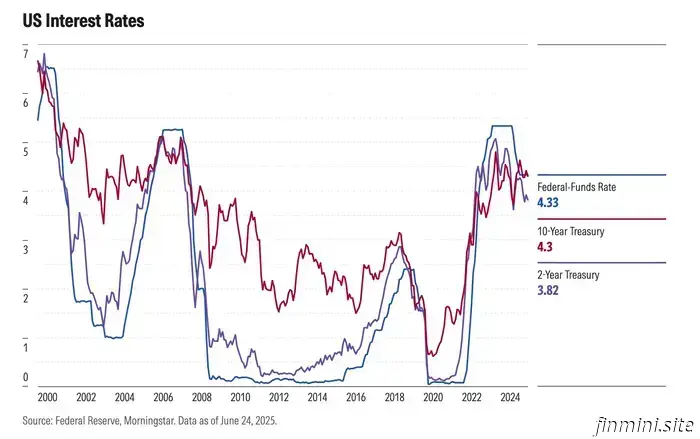

Mortgage rates increased following the Fed's rate cut. Discover how market timing, rate locks, and potential future cuts may influence your upcoming home purchase decisions.

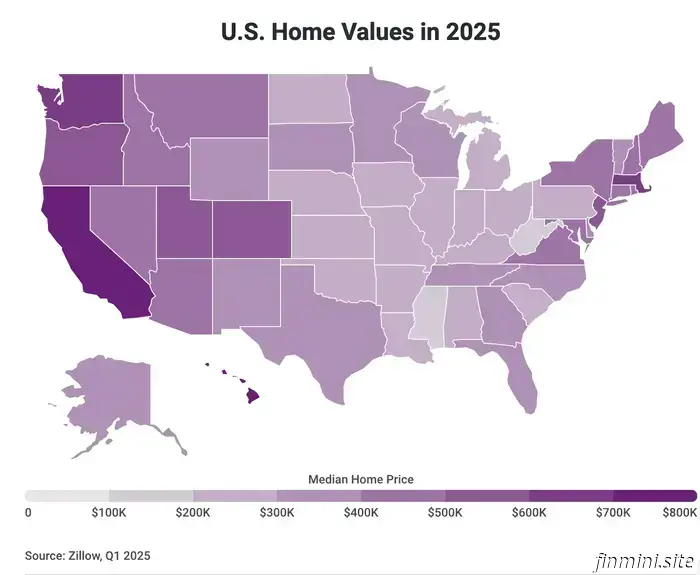

Questioning whether to purchase a home? Discover how to evaluate the mathematical, mental, and lifestyle considerations before making a decision to buy, rent, or invest elsewhere.

Discover how to evaluate the rent versus buy choice through the price-to-rent ratio, enabling you to make a more informed decision towards achieving financial freedom.

Bitcoin has recently hit record highs, not only on a single day. Consider the implications of this for your investments in light of the ongoing volatility and economic uncertainty.

Individuals affected by FEMA-declared disasters might be eligible for specific IRS tax relief, possibly even for previous years. Discover how to revise your tax returns, what records to maintain, and the procedure for claiming these benefits.

Explore methods for handling finances while working part-time. Maintain a balance between cash flow, debt, and savings, all while providing for your family.

.jpg)

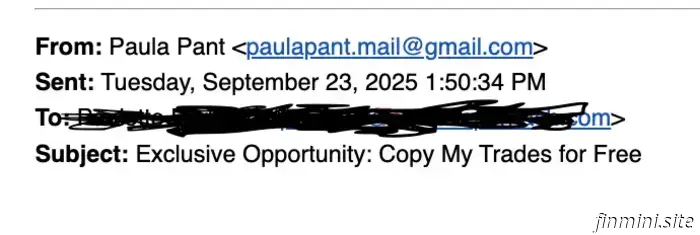

Discover ways to assist someone in investing even if they're not interested. Paula Pant offers straightforward methods to ignite action and create wealth.

Discover how to identify an email scam, safeguard your personal information, and steer clear of phishing attacks that threaten your finances and online safety.

Explore how mindset and actions influence financial achievement. Daniel Crosby offers perspectives on money, emotions, and the process of building lasting wealth.

Gain early retirement insights from former Fed economist Karsten Jeske. Discover how interest rate reductions and market trends influence your journey to financial independence.

David Gardner, co-founder of Motley Fool, joins Paula to discuss his approach to "Rule Breaker" investing. He emphasizes the importance of looking beyond short-term market fluctuations to spot companies that have the potential to change the world. Gardner also shares insights on why stocks deemed "overvalued" can become significant winners and how maintaining a long-term optimistic outlook is the strongest financial strategy one can pursue.

Welcome to our platform dedicated to financial minimalism—a philosophy and set of practices designed to simplify your financial life and help you make more conscious decisions about your money. We focus on reducing wasteful spending, identifying your most important financial priorities, and building a stable foundation for long-term security.

Here, you’ll find step-by-step guides and practical tips to develop healthy financial habits, from budgeting basics to smart investing strategies. Our goal is to show you that financial minimalism doesn’t mean sacrificing comfort; instead, it allows you to redirect your funds toward what truly matters—travel, personal growth, or those special purchases that bring real value and enjoyment.

We feature real-life success stories from individuals who have embraced financial minimalism and experienced positive changes in their lives. You’ll also learn about the psychological aspects of saving and spending, empowering you to make well-informed decisions and maintain control over your finances. Join our community of like-minded individuals and take the first step toward greater financial freedom, less debt-related stress, and a more intentional approach to money management!