Discover how the “pain of paying” diminishes with the use of cards and one-click checkout, and find out how to cultivate healthier spending habits using these easy tips.

Utilize AI investment tools intelligently—by reviewing SEC filings and identifying optimism bias—to enhance the speed and precision of your investment choices.

Discover how to recruit beyond just résumés by identifying mental frameworks, response times, and work style tendencies that indicate a team's potential for success.

Explore how your purchasing decisions are influenced by emotions and values, and find out four questions that can help you steer clear of impulse buys during Black Friday and afterward.

Obtain the crucial financial and legal measures for elder care, including power of attorney, estate planning, and important long-term care considerations.

Learn how to approach disruption with assurance and clarity. Understand the mindset, values, and tactics that transform swift changes into significant development.

A 50-year mortgage will not address affordability issues. Discover how these loans may drive home prices even higher and entrap buyers in prolonged debt.

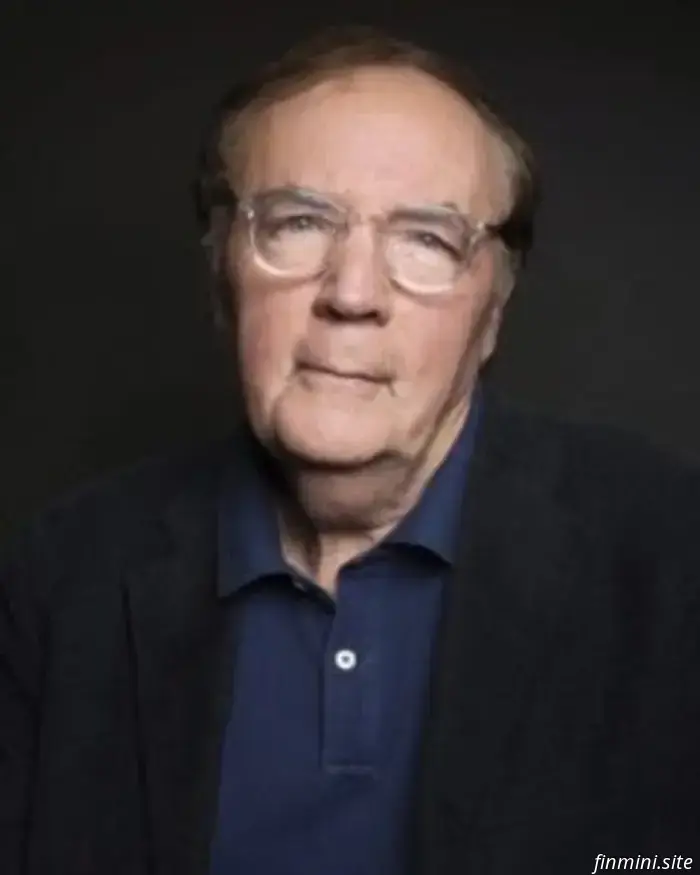

Disruption has evolved beyond just a buzzword; it has become the new standard. In this episode, bestselling author James Patterson and Vanderbilt professor Patrick Leddin discuss how disruption influences careers, industries, and individual identity. They present a framework for becoming a positive disruptor, an individual who transforms chaos into opportunity.

This First Friday episode is unique as we do not have a jobs report.

Interested in copy trading strategies? Paula Pant and Joe Saul-Sehy discuss why mirroring politicians’ stock selections might not be a worthwhile approach.

Discover how to manage saving for a home while also investing for early retirement. Paula and Joe offer useful advice for savvy savers.

Learn how to leverage your finances to gain time freedom — the capacity to live according to your own preferences, create opportunities, and dedicate more time to what is genuinely important.

Learn how Rose Han overcame Wall Street burnout to establish a seven-figure business, refine her money mindset, and achieve genuine financial freedom.

Learn how Rose Han overcame Wall Street burnout to establish a seven-figure business, refine her money mindset, and achieve genuine financial freedom.

Welcome to our platform dedicated to financial minimalism—a philosophy and set of practices designed to simplify your financial life and help you make more conscious decisions about your money. We focus on reducing wasteful spending, identifying your most important financial priorities, and building a stable foundation for long-term security.

Here, you’ll find step-by-step guides and practical tips to develop healthy financial habits, from budgeting basics to smart investing strategies. Our goal is to show you that financial minimalism doesn’t mean sacrificing comfort; instead, it allows you to redirect your funds toward what truly matters—travel, personal growth, or those special purchases that bring real value and enjoyment.

We feature real-life success stories from individuals who have embraced financial minimalism and experienced positive changes in their lives. You’ll also learn about the psychological aspects of saving and spending, empowering you to make well-informed decisions and maintain control over your finances. Join our community of like-minded individuals and take the first step toward greater financial freedom, less debt-related stress, and a more intentional approach to money management!