Hello, everyone. So... the Fed lowered interest rates on September 17.

You might be thinking:

"Wow, Paula. That news is three weeks old. Why are you writing about it now?"

Yes, that's correct.

"What will you tell us next? That we landed on the moon or Pearl Harbor was attacked?"

Fair point.

But here's the thing:

Sometimes it's beneficial to take a moment, breathe, and assess the situation before jumping into commentary.

I know — it’s a surprising idea in today’s 24-hour news environment. It contrasts with how mainstream media operates.

However, this approach allows us to step back, gain a broader perspective, and recognize — after we've paused and evaluated — what truly matters versus what is just noise.

Often, the best analysis emerges after the initial headlines fade.

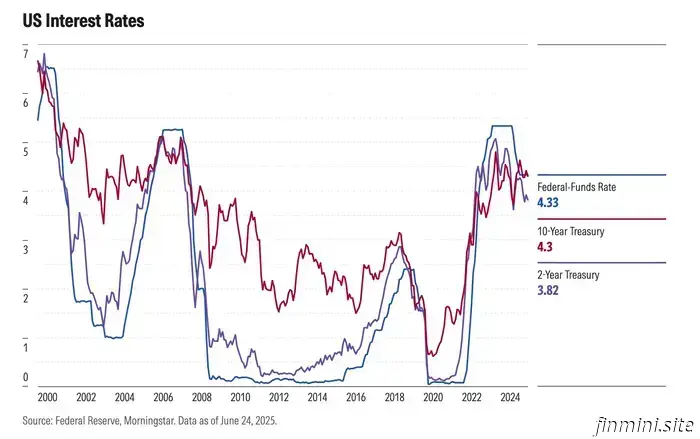

The day after the Fed lowered rates, headlines blared about a slight increase in mortgage rates. This puzzled people and dominated financial discussions on social media on September 18.

Now that things have calmed down, we can see the larger picture.

So let me provide you with a comprehensive economic update for October — where things stand currently and what it signifies for you.

#1: “Buy the Rumor, Sell the News”

On September 17, the Fed lowered rates by a quarter point. This was so anticipated that the markets had already factored in an absolute certainty that it would happen.

Before the Fed meeting, futures markets were betting 91 percent on a quarter-point cut and 9 percent on a half-point cut.

Here’s where it gets interesting:

The day after the cut, mortgage rates actually rose slightly. People were alarmed. “Wait, the Fed cut rates, but my mortgage rate went up? What’s going on?”

The explanation is simple: markets had already adjusted for the cut prior to it taking place.

This is something former Fed economist Karsten Jeske (“Big ERN”) refers to as “buy the rumor, sell the news.”

When everyone expects something, the market reacts in advance. Then, when it actually occurs, there’s no new information to respond to.

So, if you want to benefit from a Fed rate cut, the optimal time to act is before it occurs.

Fortunately, that opportunity is still available. The Fed is widely expected to announce two more cuts this year, on October 29 and December 10.

“It appears that the market is anticipating back-to-back rate cuts for the rest of this year,” Karsten mentioned in our recent podcast interview. “One in this [September] meeting, one in October, and one in December.”

He and I discussed this in a livestream interview in Portland, Oregon last month, focusing on the potential implications of the anticipated series of rate cuts.

I asked him when the best time would be for someone considering buying, selling, or refinancing their home — if they have some flexibility.

He provided a stock market analogy.

“[Imagine] an event where you think, ‘Oh, this is going to be great’ — for a stock. They’re going to release their earnings or announce a new product. That’s often the peak moment of that cycle.

“And then after that [announcement], the excitement tends to fade.

“And [rates] could behave similarly, right? Where the bond market has already factored in these favorable rate cuts based on expectations.

“I’d almost suggest, if you need to time a decision, [it] might be wise to do it around the time they first announce the series of rate cuts.”

In other words, now. October through December.

But if you can’t act immediately, don’t worry. The markets are predicting future cuts in 2026 as well.

So where do we currently stand?

As of the week of October 5, the national average for a 30-year fixed-rate mortgage was 6.37 percent, according to Bankrate. This is quite close to the 52-week low of 6.26 percent.

Here are two important pieces of context:

First, 6.37 percent is actually quite average when considering a 40-year perspective. These rates may feel high because we were accustomed to the low rates during the 2008 to 2020 period. That time was the exception, not the norm.

Second, a larger issue is the lock-in effect. According to National Mortgage Professional, 80 percent of existing homeowners hold a mortgage rate below 6 percent. Over half — 52.5 percent — have a rate below 4 percent. One in five homeowners has a rate below 3 percent.

This situation discourages most homeowners from selling, as they would exchange their low rates for higher ones.

Thus, we see very few buyers in the market.

— Existing homeowners, who have the benefit of equity and

Mortgage rates increased following the Fed's rate cut. Discover how market timing, rate locks, and potential future cuts may influence your upcoming home purchase decisions.