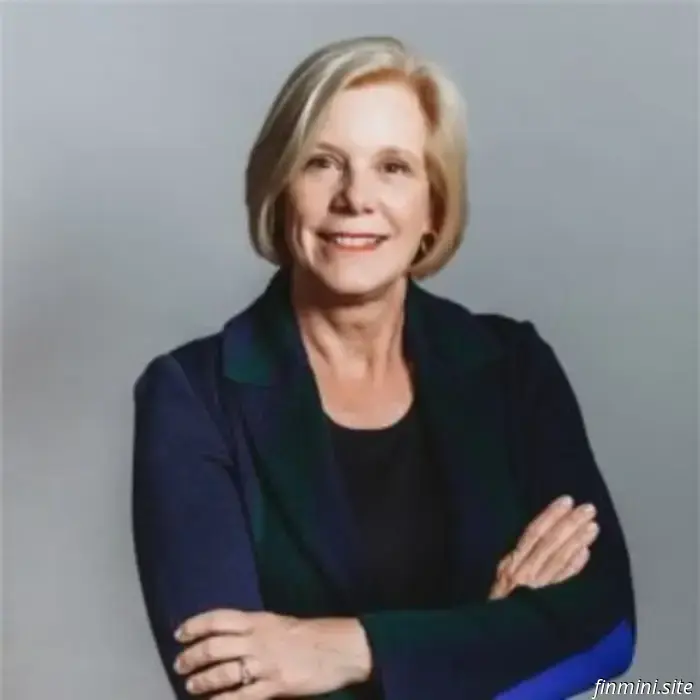

Sarah Williamson is someone who influences decisions affecting trillions of dollars. She graduated with distinction from Harvard Business School with an MBA and holds both the CFA and CAIA designations, which are among the most rigorous credentials in finance.

In this episode, she clarifies how investing truly functions, identifies the main players involved, illustrates how capital circulates within the system, and discusses the conflicting incentives among investors, activists, and asset managers.

With over twenty years at Wellington Management, where she became a Partner and Director of Alternative Investments, Sarah has also worked at Goldman Sachs, McKinsey & Company, and the U.S. Department of State. Currently, she heads FCLTGlobal, an organization committed to helping companies and investors emphasize long-term value creation. Additionally, she is the author of The CEO’s Guide to the Investment Galaxy.

Sarah discusses the dominance of index funds in corporate ownership, the impact of Reddit and retail traders on market dynamics, and the implications of activists urging companies to "bring earnings forward." She also presents a framework for understanding the “five solar systems” of investing, providing a perspective that connects everyone from day traders to trillion-dollar sovereign wealth funds.

Whether you are a passive investor or just curious about market motivations, this episode offers insights into how capital flows and its significance.

Key Takeaways:

- The Reddit and meme-stock phenomenon has fundamentally altered how individual investors affect markets.

- Index funds have taken a commanding role in ownership, leading to both stability and new challenges for corporations.

- Activists typically favor short-term profits over fostering long-term innovation.

- Sovereign wealth funds operate like national endowments, investing with a long-term perspective.

- Knowing who owns what and their motivations allows you to become a more knowledgeable and assured investor.

Resources and Links:

- The CEO’s Guide to the Investment Galaxy by Sarah Williamson

- FCLTGlobal, a nonprofit that supports companies and investors in focusing on long-term value creation.

- Explore more investing topics here.

Chapters:

(Note: Timestamps may differ on individual devices due to dynamic advertising segments. The listed timestamps are estimates and might vary by a few minutes based on ad lengths.)

(00:00) Introduction to Sarah Williamson: CEO, CFA, Harvard MBA, global finance expert

(5:41) The five “solar systems” that structure the investing environment

(7:55) The impact of Reddit and the emergence of retail investors

(16:25) Tesla, brand loyalty, and shareholder activism

(22:57) The generational investment strategies of sovereign wealth funds

(28:57) Insights into asset managers and their motivations

(41:56) The conflict between activist investors and the balance of short vs. long term.

If you want to grasp the real power dynamics driving modern investing, from Reddit traders to trillion-dollar funds, tune into this episode.

A word from our sponsors!

Policy Genius:

Secure your family's future with Policygenius. Visit policygenius.com to compare life insurance quotes from major companies and see how much you might save.

Quince:

Discover your fall essentials at Quince. Go to quince.com/paula for free shipping on your order and 365-day returns.

Shopify:

Start your one-month trial for just one dollar per month and begin selling today at shopify.com/paula.

Indeed:

To find exceptional talent to strengthen your team, visit Indeed. Go to indeed.com/paula and commence hiring with a seventy-five dollar sponsored job credit.

Sarah Williamson, CEO of FCLTGlobal and an MBA graduate from Harvard, discusses how investors create long-term value and the influence of capital flows on current markets.