I paid rent today and also collected rent today. Ever since moving to New York City, I've had this unique experience on the first of every month, which contradicts the societal norms about adulthood.

The traditional narrative suggests that after graduating college, one should get a job, purchase a primary residence without the need for roommates or any form of property monetization, and live happily ever after.

This conventional approach implies that you cover all housing expenses out of your own pocket, which sounds quite pricey. It's understandable why many people feel frustrated with how unattainable this goal has become for individuals across various income levels.

However, in striving to determine affordability, we often overlook a larger question: should you even aspire to do this?

Does owning a primary residence actually make sound financial sense?

Moreover, isn’t this goal somewhat limited? Why must the American Dream be defined in such a narrow manner?

Who truly benefits from this conveyor belt mentality, aside from large builders and the consumer market that profits when we purchase home furnishings and appliances?

There's a more effective way to approach this. Let me suggest an alternative scenario:

You could graduate from college, attend a trade or vocational school, join the military, or start your own business — possibly a combination of these paths. You work to expand the gap between what you earn and what you spend, which is the basis of personal finance.

After a few years of saving, you wouldn't simply accept the conventional advice to buy a home, nor would you bemoan the inaccessibility of starter homes. You come to understand that catchy phrases like “renting is just throwing money away” are overly simplistic and an inadequate foundation for a decision worth six figures. Such slogans mainly benefit the real estate industry, which profits from commissions and transaction volumes.

You choose not to be influenced by simplistic phrases.

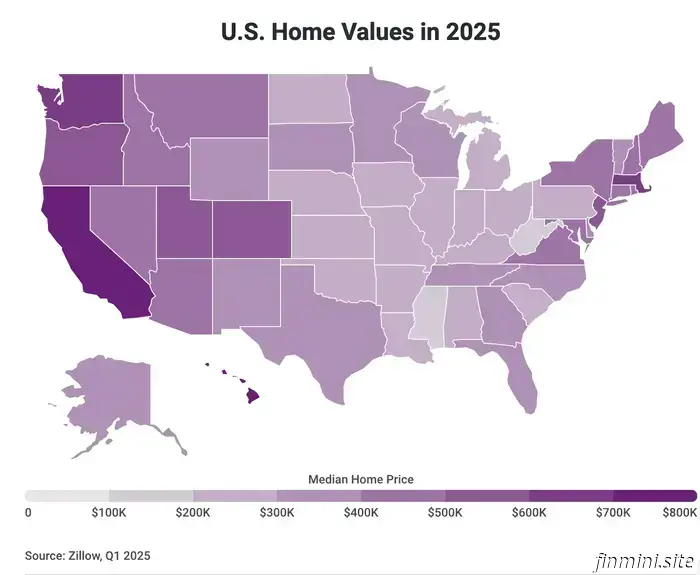

Instead, you let the math guide your decisions. For housing, this means assessing the price-to-rent ratio in the area where you wish to live. You could evaluate the price-to-rent ratio of a city, town, or neighborhood overall or focus on a specific property.

Habitual number-crunchers might spend a Friday night comparing both options — a reasonable way to approach such a significant financial choice. The price-to-rent ratio is calculated by dividing a property's price by its annual rental income.

For instance:

In Location A, a $350,000 home can be rented for $1,200 a month, totaling $14,400 per year, resulting in a P/R ratio of 24.31.

In Location B, the same home rents for $2,200 per month, leading to an annual cost of $26,400, with a P/R ratio of 13.26.

Here’s how to interpret this figure:

If the P/R ratio is below 15, it may be worthwhile to pursue the traditional route of buying a home and achieving the conventional American dream.

If the P/R ratio exceeds 25, you should opt not to buy a home in that area, preferring to rent indefinitely. As a renter, you would save money compared to being an owner, which you could invest in an S&P 500 index fund for historically better returns. This approach could allow you to save and potentially retire earlier.

A P/R ratio between 15 and 25 presents a gray area:

— A ratio of 15 to 20 leans toward buying

— A ratio of 20 to 25 suggests renting (though buying may still be reasonable if you plan to hold the property long-term and if holding costs like taxes, insurance rates, and HOA fees are low)

Now imagine living in an area where the P/R ratio is over 25. It would make financial sense to rent your home. However, if you strongly desire to own a home — for psychological stability or personal preference — what are your options?

You have two choices:

a) House hack your primary residence

or

b) Rent your primary residence while purchasing investment property in an area with a P/R ratio below 15.

Let’s examine both options.

Option A: House hacking.

This means you’ll monetize your property.

You could purchase a duplex, triplex, or fourplex, living in one unit while renting out the others.

Alternatively, you might buy a single-family home with a separate garage, accessory dwelling unit, or walk-out basement that can be converted into a self-sufficient unit. Although it isn’t classified as a duplex, it functions similarly — you live in one unit and rent the other.

Or you could simply find a traditional roommate, as many extended families or friends do—perhaps you and your brother or best friend decide to share a space, like Uncle Jesse and Joey in Full House.

Everyone’s comfort levels and situations will vary.

But the key takeaway is that part of your home can actually generate income rather than just consuming it.

This was how I began my journey, and

Discover how to evaluate the rent versus buy choice through the price-to-rent ratio, enabling you to make a more informed decision towards achieving financial freedom.