As odd as it might seem, achieving financial freedom can be easier for some individuals than truly embracing it once attained. If the following statement resonates with you, you may be facing this same struggle:

“I believe I'm nearly at the point where I can retire early, but not quite there yet. So, I'm extending my work for another year, starting another side project, and doubling my efforts to ensure greater certainty.”

That sounds reasonable, right? After all, it’s wise to be cautious, as the saying goes.

However, the issue is that these individuals continuously repeat this mindset, regardless of their savings amount or actual living expenses. No matter how favorable their financial situation appears, they perpetually downplay their savings and overestimate potential future expenditures to prepare for the unforeseen.

In leaning excessively towards “safety,” they neglect what should counterbalance that: “making the most of your limited time on this wonderful planet.”

This phenomenon occurs more frequently than one might think. I encounter it weekly in my emails and during face-to-face interactions with acquaintances. This fear is also prevalent among some of my personal friends, so let’s examine a few subtle examples from that circle to identify symptoms (and potential remedies) of this well-known condition known as One More Year Syndrome.

Alina’s Conservative Withdrawal Rate

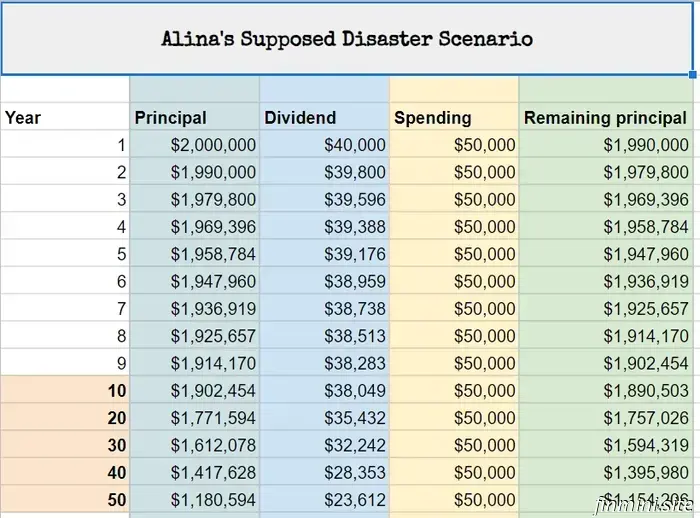

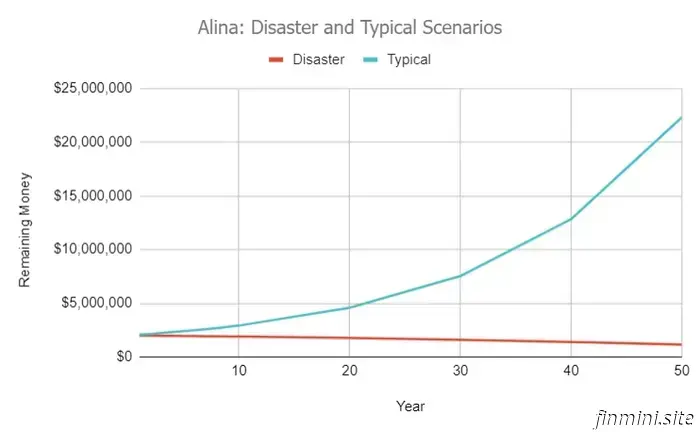

Alina is a single doctor, aged 50, immersed in a demanding yet lucrative field. She has one adult child and approximately $2 million in investments, spending around $50,000 per year, which covers all her essential needs.

According to The 4% Rule, Alina's investments could yield a reliable income of approximately $80,000 annually for her lifetime. In other terms, her projected expenditure of $50,000 represents a mere 2.5% withdrawal rate from her $2 million. While 4% is generally deemed safe, a 2.5% withdrawal rate is overly cautious.

But there’s more. In her efforts to be prudent, Alina has intentionally overlooked several significant aspects of her financial future:

1. Future Social Security income (potentially over $2,000 monthly for the last two to three decades of her life).

2. A high-probability inheritance from her parents, who are wise and active but in their early 80s.

3. An assumption that she will never share living expenses with another partner, despite being an attractive and social person with many opportunities.

Her reaction to this heightened caution? She decides to work for another year or three in the demanding operating room, forgoing luxuries to save an additional few hundred thousand for “just in case.”

Dave’s Illusory Bright Outlook

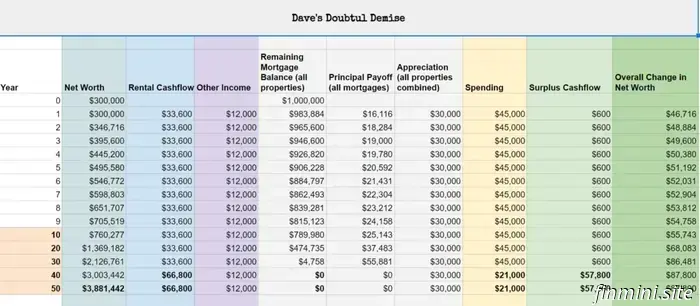

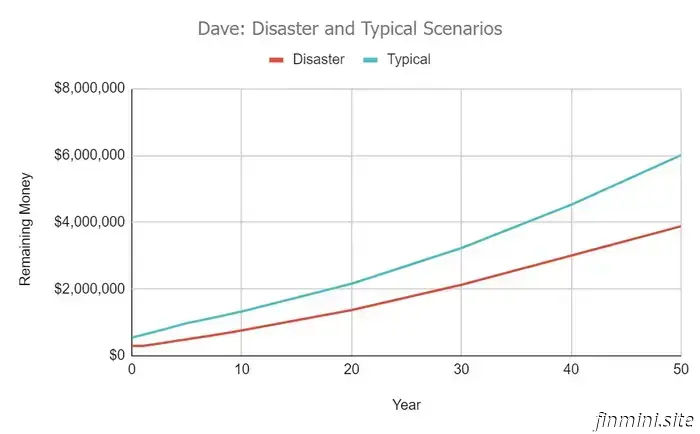

My other friend, Dave, is ten years younger than Alina, with a lower income but equally resourceful and entrepreneurial spirit. He has excelled in a notably underpaid full-time job for over fifteen years, with annual expenses – including a mortgage on a $430,000 home in Longmont – totaling around $45,000.

Despite residing in a high-cost area like Colorado, Dave has prudently acquired eight rental apartments in his hometown (a mid-sized city in Ohio), which conservatively generate a net cash flow of $2,800 monthly while boosting his wealth by an additional $3,000 monthly through principal payments and property appreciation.

Additionally, he operates a few side gigs, assisting local entrepreneurs at our community coworking space, earning him another $1,000 monthly.

The real surprise? Over the past seven months, Dave and I collaborated to renovate the main floor of his relatively expensive home into a high-end Airbnb rental. We recently launched it, and it became an immediate success with almost no vacancy, now generating an extra $5,000 per month, all while he retains the finished walkout lower-level apartment to live in.

Thus, Dave lives in his basement while collecting $5,000 monthly, spending merely $2,000 on the mortgage. In other words, he lives rent-free and earns an additional $3,000 simply from owning this property, a strategy known as the “Mustachian Inversion.”

When summed up, his total income from business sources equals $8,800 monthly ($105,600 annually!), significantly overshadowing his $45,000 in expenses, even without factoring in the salary from that undesirable full-time job he has long desired to leave.

Moreover, considering the additional $3,000 per month from paying down the mortgage principal and appreciating the rentals, his side hustles yield an astounding $140,000 annually. His bank account reflects this success, showing substantial cash reserves along with maintenance and contingency funds for his rental units, in addition to a well-endowed personal 401(k) and all other responsible financial preparations imaginable.

You might feel a tinge of jealousy toward Dave, as he is well-positioned to relax and enjoy the fruits of his labor for the rest of his life. He could halve his income, and his wealth would still grow rapidly indefinitely.

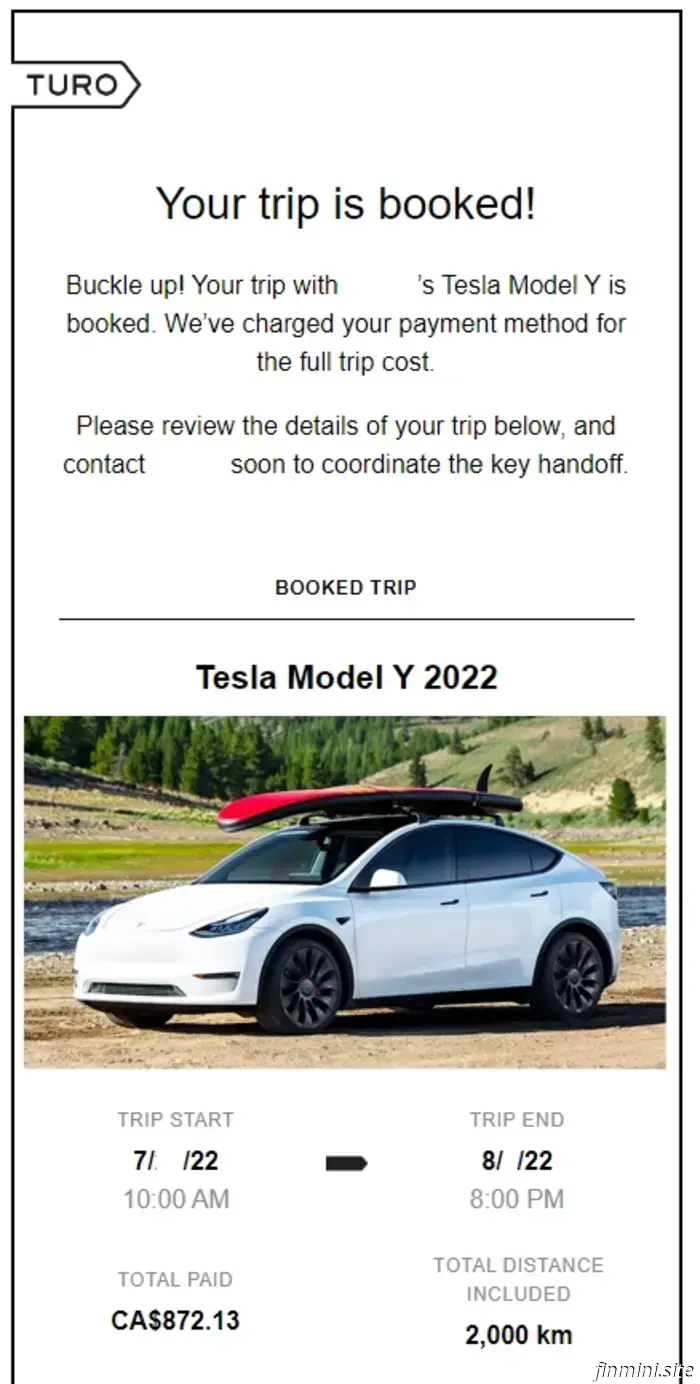

Here’s the new vehicle, on its inaugural camping excursion shortly after receiving it. As I write this, I'm navigating the different steps involved in purchasing a 2023 Tesla Model Y, which is quite costly...

.jpg)

It seems it's happened once more. Since our last conversation, I found myself immersed in constructing my 17th (?) kitchen, and I have finally come out of its chaotic yet captivating hold as I stand h...

.jpg)

Another great day in Retirement. In our recent conversation about Inflation, a Badass reader came by and captured my interest by sharing this piece of wisdom in the comments section:

Wow, have you noticed the recent changes in interest rates!? Out of the blue, after nearly fourteen years of stability in our financial landscape, it's as if someone turned the tables and now everything is q…

One reason I write less frequently these days is that my life has slowly transformed into a Personal Finance Bubble. The individuals in my surroundings have become intentional with their finances,…

Let’s get straight to the main point: A new documentary titled Get Smart With Money was released on Netflix TODAY*. Somehow, the old Mr. Money Mustache and a few of his friends found themselves drawn into participating...

As odd as it might seem, achieving financial freedom can be simpler for some individuals than actually enjoying that freedom once it's attained. If the subsequent statement resonates with you, you m…