Wow, have you noticed the recent changes in interest rates?

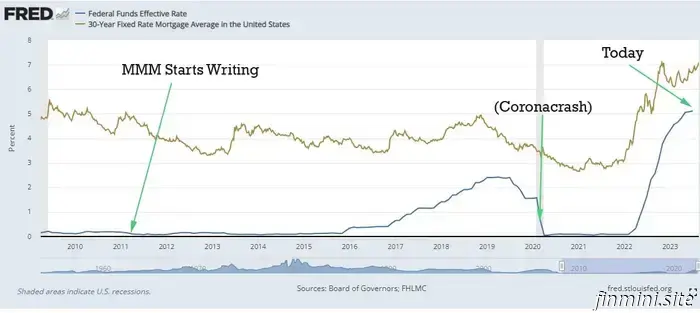

Out of the blue, after about fourteen years of stability in the financial landscape, everything has shifted dramatically.

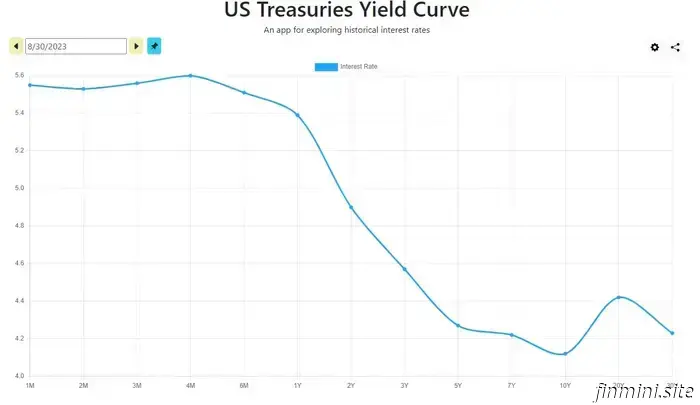

Interest rates, which have been hovering near zero since before the rise of Mustachianism back in 2011, have suddenly surged back to levels not seen in two decades.

–

This raises several questions about whether we should be concerned or take action regarding this new situation.

Is the stock market (specifically index funds) still the most suitable place for my investment?

What if I'm looking to purchase a home?

And regarding my current home – should I hold onto it forever given the fantastic 3% mortgage I have secured for the next 30 years?

Will interest rates continue to rise?

And is there a chance they will ever decrease again?

These queries are on everyone's minds these days, and they’ve been occupying my thoughts as well. While I've come across numerous detailed articles about each interest rate adjustment in financial publications, none really tackle the crucial point, which is,

“Yes, interest rates are significantly higher, but what should I do in response?”

So let’s discuss strategies.

Why Is This Happening and How Did We Get Here?

*

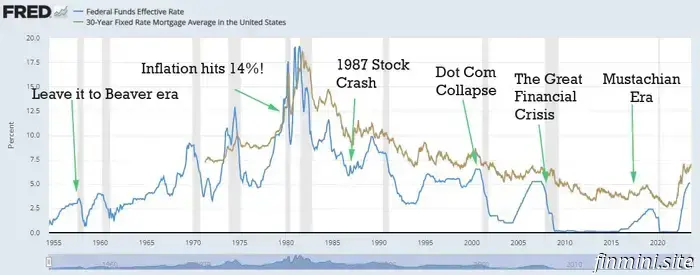

Interest rates serve as a massive accelerator for our economy, with Federal Reserve Chairman Jerome Powell's polished black shoe pressing down hard on the pedal.

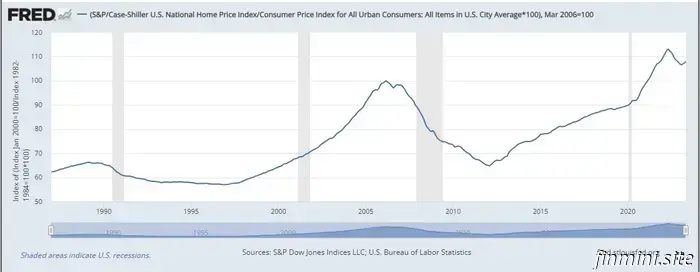

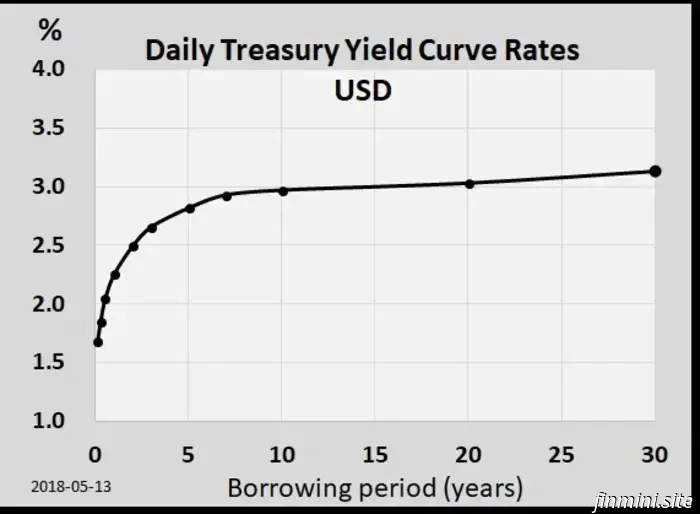

For much of the past twenty years, Jerome’s team and their predecessors have kept that pedal firmly pressed down, pumping a potent stream of easy money into the economy through near-zero rates. This made home loans more affordable, prompting many to stretch their budgets for houses, which in turn sparked demand for both existing homes and new builds.

A similar trend occurred in business investment: with borrowing costs low, entrepreneurs borrowed extensively to launch new ventures. These businesses then rented premises, built factories, and hired staff—who then contributed to the economy by purchasing more houses, cars, appliances, iPhones, and all the other luxuries of modern life.

This created a prosperous environment over two decades, marked by growth, innovation, and the typical good things that arise in a thriving economy.

But eventually, we reached a point where too much money was chasing too few goods—especially housing. This imbalance led to unacceptably rapid inflation, which we've addressed in a previous article.

Housing market distortion

Noticing this shift, Jay-P adjusted his approach by lifting his foot off the Easy Money accelerator. When interest rates rise, it dampens most economic activities.

Currently, as mortgages become considerably more expensive, potential buyers are delaying their home purchases. Companies find borrowing to be more costly, leading them to scale back on new factory plans and reduce hiring. For instance, Facebook laid off 10,000 employees, and Amazon cut 27,000 jobs.

We also experienced a minor banking crisis in which some mid-sized banks failed, stoking fears of a larger financial collapse.

All this sounds concerning, and if you follow the news, you'll inevitably encounter the usual partisan bickering. Different groups have conflicting explanations:

It’s the President’s fault for increasing the money supply and elevating the debt! We need fiscal responsibility!

No, it’s the Fed's fault for hiking rates; we need to lower them to help struggling middle-class Americans!

What are you two talking about? The entire system is corrupt and we don’t even need a central bank. Long live Bitcoin as the true currency!!!

The one consensus among these factions is that we are “facing hard economic times” and that “the country is going in the wrong direction.”

Ironically, that narrative is quite misguided—unemployment has reached 50-year lows, and the economy is thriving, surprising even seasoned economists.

In reality, we’re merely letting the economy stabilize after indulging on too much easy money. This cyclical adjustment is normal, occurring every couple of decades, and is not a crisis.

So, should I withdraw my money from the stock market due to a looming crash?

The answer is consistently the same, and you'll find it reiterated every time we discuss stock investing: Absolutely not!

Historically, the stock market trends upwards over the long term, despite periodic volatility. Since we can’t predict these fluctuations until they have occurred, attempting to time the market is futile.

With the advantage of hindsight, it’s worth noting that from its peak in early 2022 until now (August 2023 when I’m writing this), the overall US market has dipped about 10%. Alternatively, viewing it since June 2021 shows it has been relatively flat, indicating two years of no significant gains outside of approximately 3% in dividends.

Given this context, I find myself about 10% more enthusiastic about purchasing my monthly share of index funds now than I was at those peak prices.

Should I turn to savings accounts since they offer 4.5%?

This question is somewhat more complex because, theoretically, we should invest rationally in the options with the

Let’s get straight to the main point: A new documentary titled Get Smart With Money was released on Netflix TODAY*. Somehow, the old Mr. Money Mustache and a few of his friends found themselves drawn into participating...

Have you ever observed that our society's daily routines are, in many ways, completely inverted? We tend to be so "busy" that we scarcely find time for exercise. Subsequently, we invest countless...

One reason I write less frequently these days is that my life has slowly transformed into a Personal Finance Bubble. The individuals in my surroundings have become intentional with their finances,…

.jpg)

Another great day in Retirement. In our recent conversation about Inflation, a Badass reader came by and captured my interest by sharing this piece of wisdom in the comments section:

As Mr. Money Mustache, I aim to be your comprehensive resource for Lifestyle Guru inspiration. Throughout the years, we have focused not only on the financial aspects of life but also on the even more significant...

.jpg)

It seems it's happened once more. Since our last conversation, I found myself immersed in constructing my 17th (?) kitchen, and I have finally come out of its chaotic yet captivating hold as I stand h...

Wow, have you noticed the recent changes in interest rates!? Out of the blue, after nearly fourteen years of stability in our financial landscape, it's as if someone turned the tables and now everything is q…