We focus on five pillars: Financial psychology, Increasing your income, Investing, Real estate, and Entrepreneurship. It’s double-ii FIIRE. Today, we’ll explore Pillar Three: Investing.

Pillar III | Investing

This letter “I” might as well be a letter T at the moment — tariffs, trade war, and turbulence.

Tariff hikes took effect today, and by Thursday's market close, the response seemed like old news. Stock indexes were varied, which is not surprising. We’ve been aware of this for quite some time, and these changes have already been factored into the market.

What remains uncertain are the long-term effects, which will unfold gradually over months and years rather than in days or weeks.

There is, however, positive news in the economy. The GDP has increased by 3 percent (partly due to decreased imports) and consumer spending remains strong (despite weak sentiment, actions are more telling than survey results).

The markets have anticipated two rate cuts from the Fed for the remainder of the year, with the initial cut likely during the Fed meeting on September 16-17.

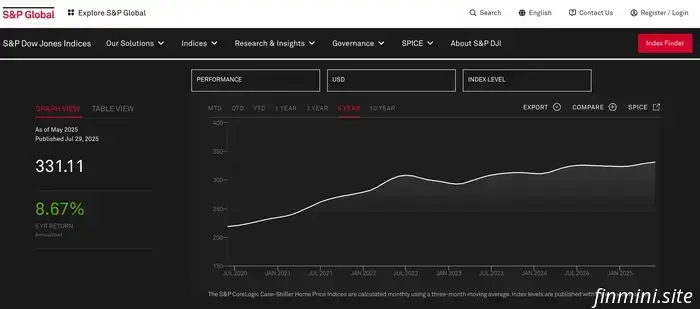

Home sales are at a 30-year low (which is advantageous for buyers), but the predicted rate cuts could increase that activity.

Now, I’d like to suggest three additional words represented by the letter T, which serve as reminders for how to manage your portfolio.

#1: Timing the Market (Don’t)

Do you remember early April? The markets dropped sharply, causing widespread panic among investors.

For about a week or two, I was inundated with DMs, emails, and voice messages from concerned individuals anxious about their declining portfolio values.

Nobody discusses that anymore.

Why? Because the markets have since recovered 28 percent from the low in April, making that anxiety a distant memory.

If you panicked and sold, you missed the opportunity for recovery.

Usually, panic selling isn’t announced with a formal declaration. Instead, it manifests through justifications that attempt to rationalize the decision post-hoc.

People might say:

“I’m becoming more conservative as I age” (even if you're only 35 and nothing has changed about your timeline).

“I want to take some profits while they’re still available” (meaning: I’m scared they might vanish).

“The fundamentals have shifted” (interpreted as ‘this time is different’).

“I’m just rebalancing” (but you did that two months ago).

“I’m moving to a more diversified strategy” (which translates to fleeing to cash or bonds due to concern).

“I require the money sooner than anticipated” (but do you really?).

The pattern remains consistent. It’s rational language that justifies emotional actions.

These justifications are what we use to excuse our panic, without acknowledging — to ourselves or others — what we’re truly doing.

On the surface, it sounds reasonable, but it conceals underlying anxiety.

If you sold in a panic during early April, there’s no shame in it; you’ve simply learned about your risk tolerance. You gained insight into how to properly allocate your assets.

If you remained steady, or even took advantage of the dip in early April, congratulations. Your genuine gain is also self-awareness; you’ve tested where you fit on the risk-reward spectrum.

The reality is: we may be heading towards a recession. That was the case in early April, and it continues to be true in early August.

However, even if a recession occurs, we cannot predict its intensity or length. Recessions don’t always equate to sharp or prolonged market downturns.

Thus, even if a recession is on the horizon, there’s no reason to sell. In fact, it can often be an excellent opportunity to buy.

#2: Timeline

The second T relates to the only kind of “timing” you should use: investing based on your life and goals timeline.

You are not timing the market; you are timing your life.

Let’s revisit the common excuse that people use in a panic: “I need the money sooner than I anticipated.”

This frequently happens when market volatility arises. Individuals suddenly believe their 15-year timeline has dwindled to five. But has it? Do you have a written plan?

Here’s the truth: If you won’t need the money for a decade or longer, today’s market fluctuations are merely noise. Background chatter.

Your actual timeline hasn’t changed simply because your stress level has.

Try this: link a specific goal to each investment.

Is it for a short-term objective (under 5 years), such as purchasing a car, travel, or home renovations?

Is it for a medium-term goal (5-10 years) with a flexible date, like acquiring a vacation home? Or does your medium-term goal have a set date, such as funding college?

Or perhaps you’re holding onto that money until

We address five key areas: Financial psychology, boosting your income, investing, real estate, and entrepreneurship. This is double-ii FIIRE.

We address five key areas: Financial psychology, boosting your income, investing, real estate, and entrepreneurship. This is double-ii FiiRE.

Paula Pant explores Financial Psychology, illustrating how anxiety about money, avoidance behaviors, and obsession with it influence your decisions—and how to create genuine wealth and freedom.

We address five key areas: Financial psychology, boosting your income, investing, real estate, and entrepreneurship. This is double-ii FIIRE.