We focus on five areas: Financial psychology, Increasing your income, Investing, Real estate, and Entrepreneurship. This is what we call double-ii FIIRE.

Today, we’ll explore Pillar Four: Real Estate.

Pillar IV | Real Estate

Alright, where do I start?

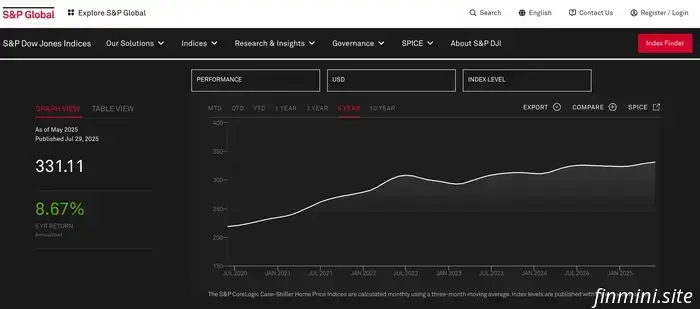

In the past five years, home prices across the country have increased at an annualized rate of 8.67 percent, as per the S&P CoreLogic Case-Shiller Home Price Index.

If you owned rental property, you experienced significant returns.

Keep in mind that asset value appreciates in two ways: appreciation and income stream.

With an appreciation rate of 8.6 percent and a conservative dividend—indicated by the cap rate—of 5 percent, your total unleveraged returns would be an annualized 13.6 percent.

The important term is “unleveraged.” If you financed your purchase, your returns could be even higher, based on cash-on-cash returns.

However, be careful not to get too carried away with cash-on-cash returns.

Currently, we find ourselves in an unusual situation.

Homeowners, particularly those who purchased before the pandemic, have seen significant equity gains. Additionally, three-quarters of mortgage holders have interest rates below 5 percent, providing them with both equity and a low-interest loan that has recently been less than the inflation rate.

(There is also a considerable number of homeowners who do not have mortgages—mainly Baby Boomers).

Consequently, current homeowners are asking: What should I do with all this equity? Should I utilize it? Buy another property? Launch a business? Invest in the market?

On the other hand, individuals who haven’t purchased homes in the last 15 years are questioning: Is it too late? Will I ever have an opportunity? What are my options?

Sometimes, addressing broad questions is best approached by focusing on specific scenarios.

Let’s get practical and examine common real-life applications of these inquiries.

Q1: My friend insists I should wait for a housing crash before buying my first home. Is that accurate?

No.

They are quite mistaken.

Crashes don’t occur simply because the market is high; they happen due to underlying weaknesses in the system, such as overbuilding and over-leverage.

We witnessed this in 2006 when there was not only excess leverage but also poorly assessed leverage.

Today’s market lacks such weaknesses. Remarkably, 40 percent of U.S. homeowners are mortgage-free (which means minimal risk of foreclosure), a significant increase from 33 percent in 2010.

Those who do have mortgages are better positioned, with lower debt-to-income ratios and higher credit scores.

Furthermore, loans sold in secondary markets are now more accurately priced.

At the same time, there is a severe housing shortage nationwide, with the Chamber of Commerce estimating a deficit of 4.5 million homes across the U.S., although this varies by region and city.

Many rapidly growing areas have not kept pace with construction, especially single-family homes.

A logical follow-up question is: “If there’s an incentive to build, why aren’t builders constructing homes? Shouldn’t supply and demand resolve this?”

The challenge is that many regions have highly regulated housing markets, as outlined by the Wharton Residential Land Use Regulation Index.

These areas often face the greatest housing supply shortages. Recent Zillow research indicates:

“One indicator of housing affordability is the strictness of a region’s land-use regulations... Those living in highly regulated housing markets are less likely to afford a typical mortgage payment, even in cities with above-average incomes. This is due to persistent housing supply shortfalls.”

These regulatory barriers can take a long time to dismantle—if they ever do—resulting in prolonged housing supply shortages.

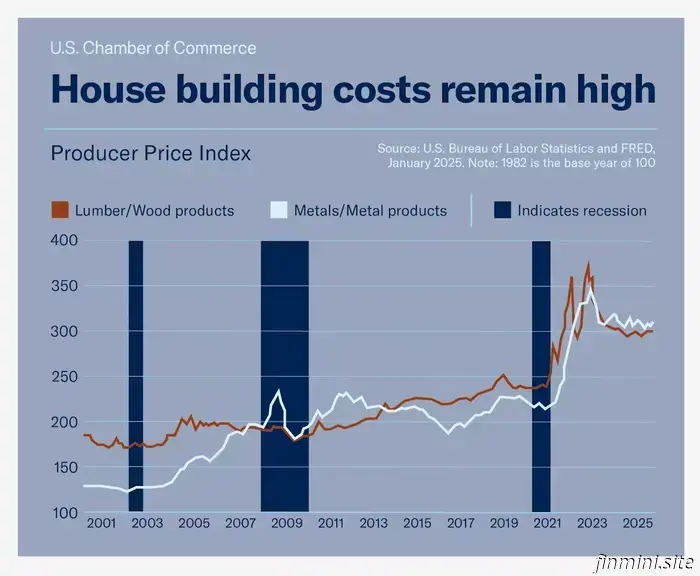

Finally, a key factor contributing to home price stability is the rise in labor and material costs associated with home building.

Prices for lumber, wood, copper, and labor have surged significantly in recent years.

So, no, don’t wait for a crash before taking action. Anyone suggesting that is relying on hope rather than data.

Q2: I want to move but would lose my 3 percent mortgage rate. Should I keep my current home as a rental instead of selling?

That depends on the cap rate, which is effectively the income stream from the property. Here’s how to calculate cap rate.

After computing that figure, you’ll get an idea of the dividend payout from the property.

This dividend payout, along with the property’s appreciation, constitutes your unleveraged return.

What’s the appreciation rate? You can reasonably estimate it to match inflation at around 3 percent, although historically, home values have increased by an annualized average of 5 percent.

Choose either figure (3 percent or

Paula Pant explores Financial Psychology, illustrating how anxiety about money, avoidance behaviors, and obsession with it influence your decisions—and how to create genuine wealth and freedom.

We address five key areas: Financial psychology, boosting your income, investing, real estate, and entrepreneurship. This is double-ii FiiRE.

We address five key areas: Financial psychology, boosting your income, investing, real estate, and entrepreneurship. This is double-ii FIIRE.

We address five key areas: Financial psychology, boosting your income, investing, real estate, and entrepreneurship. This is double-ii FIIRE.