The Federal Reserve is anticipated to lower interest rates, though inflation data presents mixed signals. There are warnings regarding the insolvency of Social Security, and the stock market appears both robust and fragile.

What actions should investors and regular savers take during this period of uncertainty?

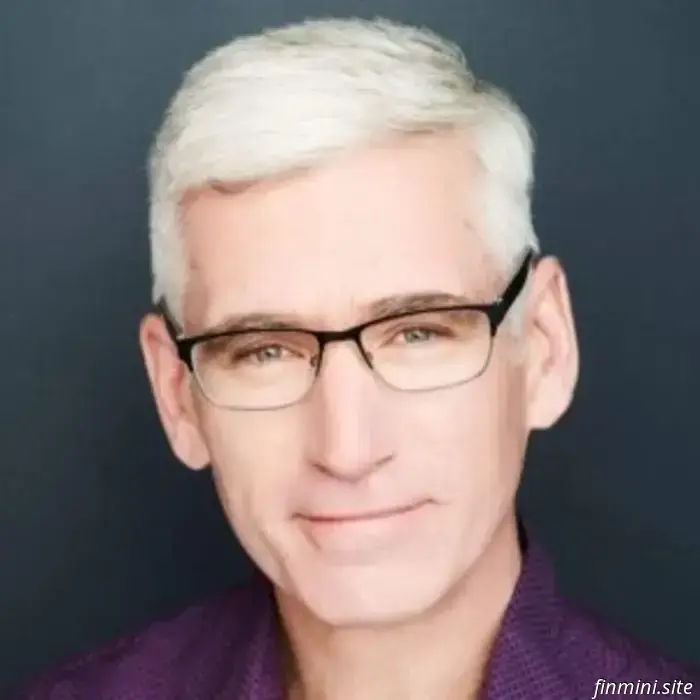

In this special bonus episode, we engage in conversation with Rob Berger — a former attorney, deputy editor at Forbes, the founder of the Dough Roller blog, the host of the Rob Berger Show on YouTube, and the author of Retire Before Mom and Dad. With over 250,000 subscribers, Rob is renowned for his straightforward, compassionate, and evidence-based financial advice.

Together, we delve into the current shifting economic environment — discussing everything from Fed policies to retirement approaches across various generations.

Key Insights from This Episode:

The Federal Reserve is struggling to balance the fight against inflation with job protection, and the implications of a rate cut.

The dangers of stagflation and the reasons behind high market valuations despite economic unpredictability.

The impact of the tech giants known as "the Magnificent 7" on the S&P 500 and what true diversification entails.

Guidelines for smart asset allocation corresponding to different life stages.

An explanation of Social Security insolvency and how to prepare for potential reductions in benefits.

Important Takeaways:

Anticipate uncertainty. Predictions regarding rate cuts and inflation are unreliable — brace for volatility.

Seek diversification beyond the S&P 500. International assets, small-cap stocks, REITs, and bonds can enhance your portfolio.

Social Security is not vanishing — but benefits may decrease. Start developing contingency plans now.

If you’re short on savings as retirement approaches, take immediate action. Reduce spending, increase savings, and prepare for hard choices.

Younger investors should concentrate on aspects they can control. Education, savings rates, and individual priorities are more crucial than the broader economic climate.

Resources & Links:

Rob Berger’s Website

Rob Berger Show on YouTube

Retire Before Mom and Dad by Rob Berger

Related Episodes:

Paul Merriman on Smarter Investing Strategies

Planning for Inflation and Rising Rates

Glossary:

CPI (Consumer Price Index): A metric for inflation measuring average price changes for goods and services.

Stagflation: An unusual economic state where inflation is high, yet economic growth stagnates.

Basis Points: One-hundredth of a percentage point (0.01%). A 25-basis-point reduction = 0.25%.

S&P 500: An index tracking 500 large U.S. corporations, commonly used as a benchmark for U.S. stock performance.

TIPS (Treasury Inflation-Protected Securities): Bonds that adjust for inflation to maintain purchasing power.

Chapters:

00:00 – 02:40 Introduction and the reason for this bonus episode

02:40 – 04:00 Rob Berger’s background and qualifications

07:27 – 13:00 Federal rate cuts, inflation, and stagflation risks

13:00 – 18:00 Market valuations, diversification, and the “Magnificent 7”

18:00 – 22:00 Social Security’s solvency and retirement planning for those in their 50s and 60s

22:00 – 25:00 Financial challenges for Gen Z and what they can still control

25:00 – 27:00 Predictions (and why they often fail)

27:00 – End Where to find Rob Berger and closing remarks

Final Thoughts:

Economic uncertainty does not have to lead to financial stagnation. As Rob Berger emphasizes, we should concentrate on what we can manage: our savings, diversification strategies, and priorities.

🎧 Listen to this relevant episode, share it with others, and subscribe to ensure you never miss our insightful and relatable discussions on finances and freedom.

Thanks to our sponsors!

Mint Mobile

Take advantage of this new customer offer and get your 3-month Unlimited wireless plan for just $15 per month at mintmobile.com/paula.

Wayfair

Refresh your space with Wayfair’s easy and affordable fall updates. Discover everything at wayfair.com for much less.

Shopify

Begin your one-month trial period for just one dollar per month and start selling today at shopify.com/paula.

Indeed

If you're searching for exceptional talent to enhance your team, turn to Indeed. Visit indeed.com/paula and kick off your hiring process with a $75 sponsored job credit.

Inflation, interest rate reductions, and market volatility — Rob Berger teams up with Paula Pant to discuss the actions investors and savers should take in the current economic landscape.