Recently, a reader of MMM commented on one of my older posts regarding the principles of FIRE:

“While I still find some of MMM’s advice relevant, it feels like most FI bloggers out there were in tech two decades ago, earned six-figure incomes, and bought homes for a pittance before 2019. I didn’t discover FI in my youth, so I often feel that much of their advice isn't applicable to me or others who don’t own homes and lack six-figure salaries in today’s post-pandemic world.

Many suggestions for young people involve “house hacking” or “buying a fixer-upper,” but those options seem complicated or unattainable with current prices and interest rates. Many municipalities near me discourage turning houses into ADUs or multiple units. My cousin has 60 acres but isn’t permitted to live in a trailer there.

I’m curious about what the next generation of FI bloggers might provide, and I wonder if they’re already out there without me knowing, but I’d like to hear from them.”–

I took some time to reflect on this feedback. I aimed to identify any Principles of Mustachianism that might genuinely be becoming obsolete, as opposed to the more typical byproducts of Complainypants and/or Excuse-itis, which have affected our critics from the start.

After all, this isn’t the first instance of FIRE being deemed obsolete. Throughout my retirement, I’ve observed it:

- dismissed as a lucky occurrence for those benefiting from the 2000 Tech Boom

- labeled as outdated following the 2009 Financial Crisis

- regarded as a fleeting result of the booming stock market in the 2010s

- attributed to the Covid-era effects of newfound freedom from remote work.

So where do we stand now?

The commenter emphasizes two factors: the solid incomes of tech workers and the substantial rises in housing prices (and interest rates) over the past four years.

The first aspect—high salaries—remains relevant, and I don't foresee that changing. Certain professions pay more than others, and there are numerous ways to enhance your income by changing jobs, which I fully support. However, I typically don’t emphasize increasing income on MMM because I’ve observed that people can squander almost any level of income and still find themselves with little to show for it.

Indeed, the mere existence of highly paid professionals like software engineers and doctors who are my age and still facing financial challenges proves this: it's mathematically impossible to earn a significant salary for nearly 30 years without accumulating substantial savings unless one is concurrently spending wealthily the entire time.

Thus, my focus is on streamlining spending and living joyfully and efficiently, prioritizing frugality. We discuss minimizing waste while still retaining—and even improving—the benefits associated with more intentional spending. These skills are crucial, especially as income decreases.

Now let's address the housing issue. Does the current housing climate in 2024 undermine the entire FIRE strategy?

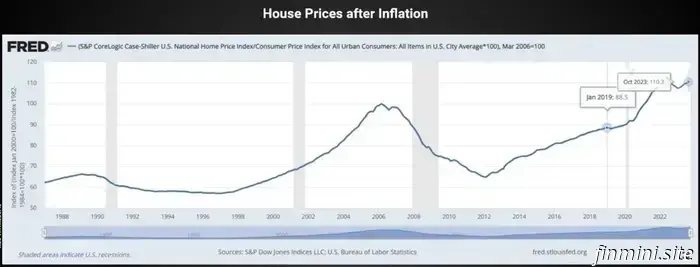

As with any inquiry, let’s review the data: how much have U.S. home prices actually increased—adjusted for inflation—since 2019?

Interestingly, the St. Louis Fed provides this invaluable data.

Our findings reveal that houses currently “feel” about 25% pricier than they did at the beginning of 2019 when adjusted for average salaries and the costs of other items. Notably, though, they’ve only risen about 10% since reaching their last peak in early 2006—eighteen years ago! So, while housing presents a challenge, it's not necessarily a death knell for FIRE.

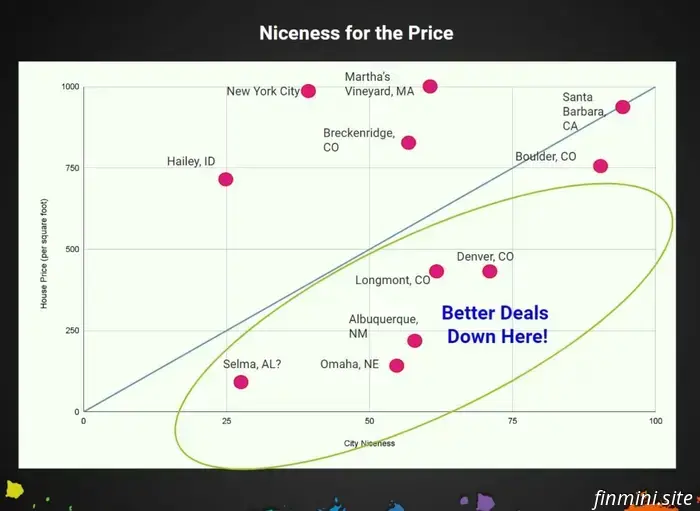

However, this nationwide data conceals much more significant spikes in popular urban areas, including my own: Longmont, Colorado now carries an astonishing median home price of $540,000. Compared to when I began writing in 2011, this means homes have tripled in price, outpacing average salary growth and placing them further out of reach for most individuals in my vicinity.

Thinking Differently About House Shopping

The answer here lies in adjusting our mindset. Instead of viewing ourselves as victims of external circumstances, we should adopt a Mustachian perspective.

Houses are simply manufactured products and come at a diverse range of price points, influenced by supply and demand.

Living in a certain place doesn’t guarantee affordability for buying a home. Just as a baby born on the Apple campus in Cupertino today won’t automatically receive a new iPhone Pro Max every year.

With any purchase decision, you should evaluate:

- Can I afford this right now?

- Do I desire it enough to make a purchase?

- Are there alternatives to fulfill those same needs, and what are their advantages and disadvantages?

- What’s the optimal way to obtain it, considering all the above points?

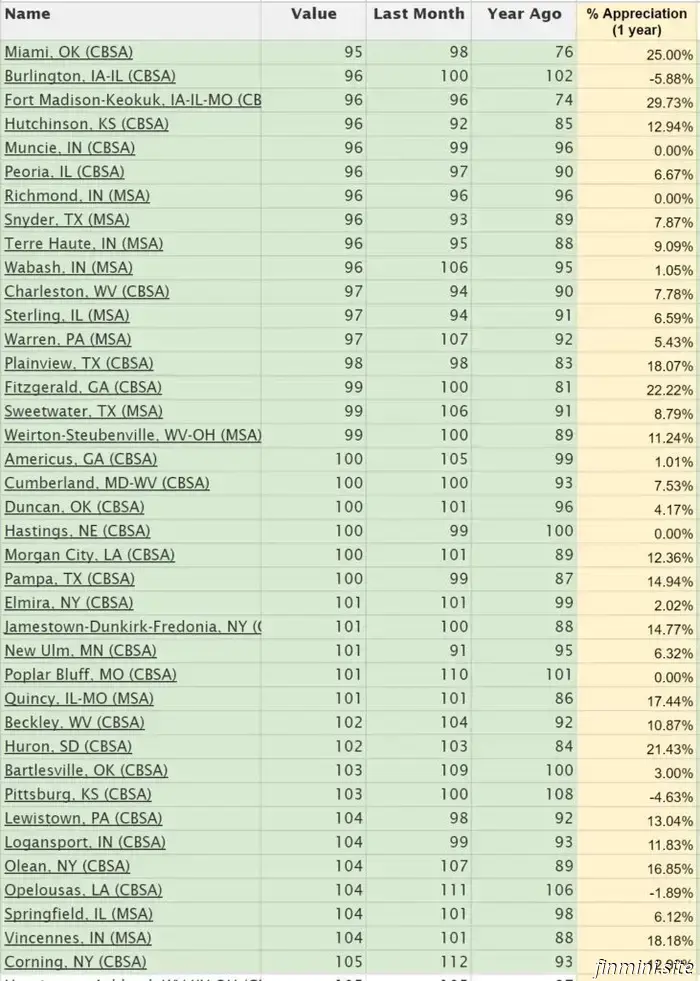

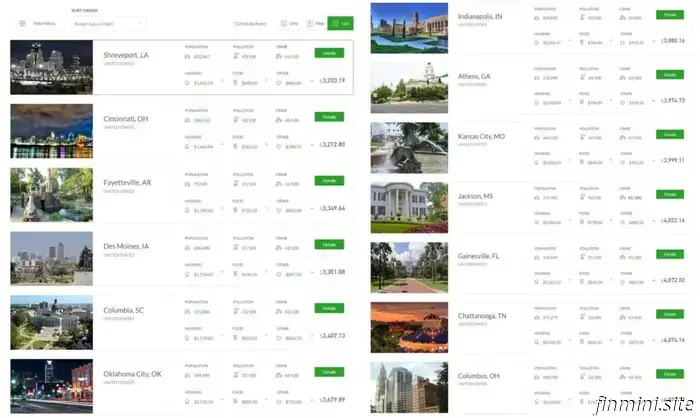

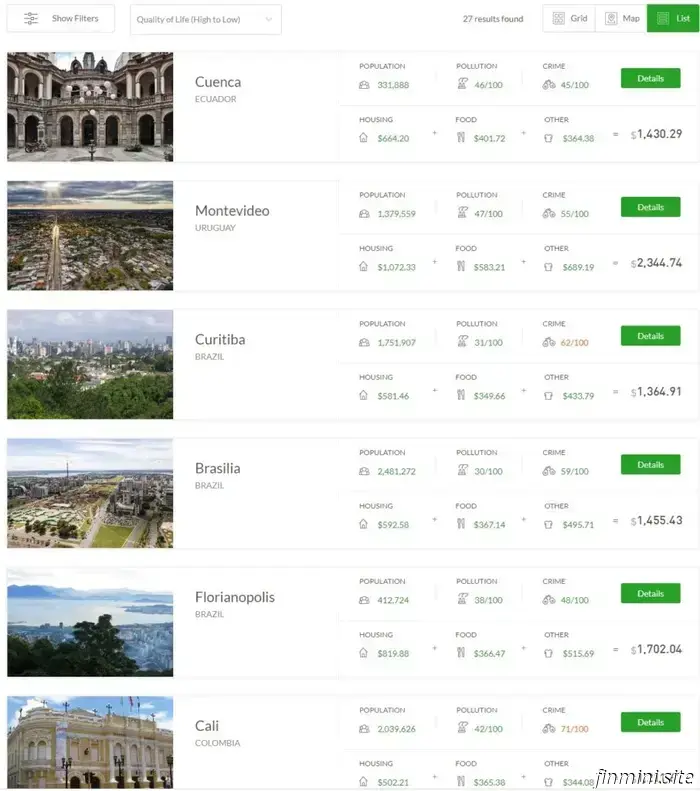

When it comes to housing, conduct the necessary calculations, then decide whether to rent, buy, or explore house hacking. Start with analysis in your own locality, but remain open to the possibility that

Two teachers in Ohio dedicated their entire lives to one aspiration — purchasing a farm.

Austin and his wife are concerned about transitioning to a single-income household while caring for two children. Should they increase their cash flow by settling their car loan, or should they tighten their budget and maintain their current situation?

Recently, a reader from MMM visited and shared a comment on one of my earlier posts regarding the principles of FIRE. Like with any critique of our concepts, I reflected on this comment...